Graham Weaver, who founded a very successful fund (Alpine Investments) when he was in business school, came to speak to a class of mine the other day. He related a remarkable quote from Goethe as he urged us to take the plunge and commit to a road less travelled. The quote really reasonated with me so enjoy!

"Until one is committed, there is hesitancy, the chance to draw back-- Concerning all acts of initiative (and creation), there is one elementary truth that ignorance of which kills countless ideas and splendid plans: that the moment one definitely commits oneself, then Providence moves too. All sorts of things occur to help one that would never otherwise have occurred. A whole stream of events issues from the decision, raising in one's favor all manner of unforeseen incidents and meetings and material assistance, which no man could have dreamed would have come his way. Whatever you can do, or dream you can do, begin it. Boldness has genius, power, and magic in it. Begin it now."

Saturday, December 09, 2006

Wednesday, November 29, 2006

Loan Consolidation & Insurance is a Yummy Business

Dudes, below is a listing of the most expensive google keywords. If you click on google ads related to these things, the companies pay around $50 to google. Crazy! I'm going to run an experiment where I start putting google ads on this site to verify if this is true. Shocking, no?

school loan consolidation - $69.16

college loan consolidation - $68.35

car insurance quotes - $66.88

school consolidation - $66.29

auto insurance quotes - $65.90 c

ollege consolidation - $64.04

student loan consolidation rates - $60.14

sell structured settlement - $59.82

sell annuity - $58.92

federal student loan consolidation - $58.58

auto quotes - $58.09

auto insurance quote - $57.99

student consolidation - $56.96

student loan consolidation - $56.91

student loan consolidation interest rate - $56.52

consolidate student loan - $54.61

san diego dui attorney - $54.56

car insurance - $53.16

structured settlement - $52.96

consolidate school loans - $52.88

student loan refinance - $52.44

consolidation of student loans - $52.43

consolidation loan rate - $52.04

citibank student loan consolidation - $51.85

car insurance quote - $51.80

consolidate student loans - $51.23

private student loan consolidation - $51.05

lasik new york - $49.86

student loans consolidation - $49.82

private loan consolidation - $48.95

insurance quotes - $48.78

teleconference services - $48.72

the art institute of seattle - $48.68

federal loan consolidation - $48.61

plus loan consolidation - $47.74

student loan consolidation programs - $47.58

bad credit equity loan - $47.46

houston criminal attorney - $47.44

student loan consolidation calculator - $47.19

cash settlement - $47.12

consolidating student loans - $47.09

orlando culinary institute - $46.84

student loan consolidation program - $46.77

orlando culinary institute - $46.69

consolidation loan - $46.54

loan consolidation - $46.54

ditech - $46.32

auto quote - $45.77

sallie mae student loan consolidation - $45.69

school loan consolidation - $69.16

college loan consolidation - $68.35

car insurance quotes - $66.88

school consolidation - $66.29

auto insurance quotes - $65.90 c

ollege consolidation - $64.04

student loan consolidation rates - $60.14

sell structured settlement - $59.82

sell annuity - $58.92

federal student loan consolidation - $58.58

auto quotes - $58.09

auto insurance quote - $57.99

student consolidation - $56.96

student loan consolidation - $56.91

student loan consolidation interest rate - $56.52

consolidate student loan - $54.61

san diego dui attorney - $54.56

car insurance - $53.16

structured settlement - $52.96

consolidate school loans - $52.88

student loan refinance - $52.44

consolidation of student loans - $52.43

consolidation loan rate - $52.04

citibank student loan consolidation - $51.85

car insurance quote - $51.80

consolidate student loans - $51.23

private student loan consolidation - $51.05

lasik new york - $49.86

student loans consolidation - $49.82

private loan consolidation - $48.95

insurance quotes - $48.78

teleconference services - $48.72

the art institute of seattle - $48.68

federal loan consolidation - $48.61

plus loan consolidation - $47.74

student loan consolidation programs - $47.58

bad credit equity loan - $47.46

houston criminal attorney - $47.44

student loan consolidation calculator - $47.19

cash settlement - $47.12

consolidating student loans - $47.09

orlando culinary institute - $46.84

student loan consolidation program - $46.77

orlando culinary institute - $46.69

consolidation loan - $46.54

loan consolidation - $46.54

ditech - $46.32

auto quote - $45.77

sallie mae student loan consolidation - $45.69

Dear Readers

Hello! Long time no posting!

My apologies for my deliquency, but very few of you noticed my absence so I guess we're cool...

In the next few days, I'm going to use this blog as a bit of a "sandbox" to test things out of so watch out!

Also, maybe pretty soon I'll put some info here on the business I'm starting. In the meantime a few of my classmates launched these companies in the last few weeks:

www.url.com

www.ugenie.com

www.agloco.com

Smell ya later,

rohin

My apologies for my deliquency, but very few of you noticed my absence so I guess we're cool...

In the next few days, I'm going to use this blog as a bit of a "sandbox" to test things out of so watch out!

Also, maybe pretty soon I'll put some info here on the business I'm starting. In the meantime a few of my classmates launched these companies in the last few weeks:

www.url.com

www.ugenie.com

www.agloco.com

Smell ya later,

rohin

Tuesday, September 12, 2006

Hamish's Latest Column

My friend Hamish has a regular column in the Financial Times that chronicles his time at Stanford Business School. In his latest column, he has an excellent discussion of why he wants to be a truck driver instead of a hedge fund manager.

Check it out, booyah!

Stanford GSB Diary

Check it out, booyah!

Stanford GSB Diary

Wednesday, August 30, 2006

Deep Thoughts from Andy Rachleff

My classmates Julio and Matt kicked off their excellent podcast, iinnovate, with an interview featuring Andy Rachleff, co-founder of Benchmark Capital and GSB professor. Benchmark is perhaps best known as the sole VC investor in eBay as well as a major investor in Webvan.

During the school year, I had an opportunity to attend a “meet the professor” dinner with Andy and a half dozen or so classmates. The dinner really stood out as one of the best learning experiences I’ve had at the GSB. Andy has a way of capturing complex business ideas and translating them in pithy, well-crystallized statements. After the dinner, there were about four of these concepts that I mulled over for weeks; the more I thought about them, the more sense they made. He covers some of them in his interview with Matt and Julio, but I thought I’d share.

Product-market fit is everything

According to Andy, the sole driver of a start-up company’s success is how well the product fits with the market need. Put in a different way, are you making the dog food that the dogs want to eat? If you get this right, you can afford to mess up everything else. The logical extension of this, according to Andy, is that execution doesn’t matter if you have the market fit in place. I’m not sure if I agree with that last statement though. It requires quite a bit of execution to develop the product, understand the customer need, re-engineer the product, communicate the value proposition, figure out the pricing, develop a distribution channel, and bring the product to market. When I prodded him on this, I think he classified all these activities as part of establishing the “product-market fit” and not as execution.

The Groucho Marx Principle

Groucho Marx famously said “I don’t want to belong to any club that will accept me as a member”. Ain’t that the truth! I think I’ve spent my whole life seeking entrance into clubs of all sorts only to find out they weren’t so hot once I got in. But I digress. Andy’s point was that VCs never want to invest in companies that actually want their money. If the company is truly great, most likely it doesn’t want or need the capital. Though we didn’t really get into it, I think he implied that the flip-side is true as well—beware of any venture capitalist that wants to give you money.

It’s great when a major company enters your market

This was a real eye-opener for me. Most companies live in fear that Microsoft and Google will enter their market and blow them out of the water a la Netscape. Andy’s insight, however, is that more often than not, the presence of the competitor validates the product-market and as a result, actually grows the total market size significantly. So, the start-up may have a smaller share of the market, but now the market is sizable and legitimate. Not only that, but the start-up company gets fantastic free publicity vis-a-vis the entrance of a Goliath company.

80/20 is the mark of a great entrepreneur

Finally, during the dinner conversation, someone asked Andy what was it about the great entrepreneurs that he backed that made them successful. Andy’s response was that they had great vision to see what are the hand full of things that will make or break the business. After they seized on those things, they spent all their time making sure they got them right. It could be something like the pricing model, the “last mile” distribution expense, or building the direct sales force. What’s equally important is realizing, “this other 80% of stuff is crap and I’m not going to spend anytime with this crap because it’s crap” (my own words, not Andy’s).

The dinner ended with me spilling an enchilda all over my pants--but that is a story for another post.

During the school year, I had an opportunity to attend a “meet the professor” dinner with Andy and a half dozen or so classmates. The dinner really stood out as one of the best learning experiences I’ve had at the GSB. Andy has a way of capturing complex business ideas and translating them in pithy, well-crystallized statements. After the dinner, there were about four of these concepts that I mulled over for weeks; the more I thought about them, the more sense they made. He covers some of them in his interview with Matt and Julio, but I thought I’d share.

Product-market fit is everything

According to Andy, the sole driver of a start-up company’s success is how well the product fits with the market need. Put in a different way, are you making the dog food that the dogs want to eat? If you get this right, you can afford to mess up everything else. The logical extension of this, according to Andy, is that execution doesn’t matter if you have the market fit in place. I’m not sure if I agree with that last statement though. It requires quite a bit of execution to develop the product, understand the customer need, re-engineer the product, communicate the value proposition, figure out the pricing, develop a distribution channel, and bring the product to market. When I prodded him on this, I think he classified all these activities as part of establishing the “product-market fit” and not as execution.

The Groucho Marx Principle

Groucho Marx famously said “I don’t want to belong to any club that will accept me as a member”. Ain’t that the truth! I think I’ve spent my whole life seeking entrance into clubs of all sorts only to find out they weren’t so hot once I got in. But I digress. Andy’s point was that VCs never want to invest in companies that actually want their money. If the company is truly great, most likely it doesn’t want or need the capital. Though we didn’t really get into it, I think he implied that the flip-side is true as well—beware of any venture capitalist that wants to give you money.

It’s great when a major company enters your market

This was a real eye-opener for me. Most companies live in fear that Microsoft and Google will enter their market and blow them out of the water a la Netscape. Andy’s insight, however, is that more often than not, the presence of the competitor validates the product-market and as a result, actually grows the total market size significantly. So, the start-up may have a smaller share of the market, but now the market is sizable and legitimate. Not only that, but the start-up company gets fantastic free publicity vis-a-vis the entrance of a Goliath company.

80/20 is the mark of a great entrepreneur

Finally, during the dinner conversation, someone asked Andy what was it about the great entrepreneurs that he backed that made them successful. Andy’s response was that they had great vision to see what are the hand full of things that will make or break the business. After they seized on those things, they spent all their time making sure they got them right. It could be something like the pricing model, the “last mile” distribution expense, or building the direct sales force. What’s equally important is realizing, “this other 80% of stuff is crap and I’m not going to spend anytime with this crap because it’s crap” (my own words, not Andy’s).

The dinner ended with me spilling an enchilda all over my pants--but that is a story for another post.

Monday, August 28, 2006

Notes from Australia

Greetings from down-under! After a 15 hour plane ride and a 3 hour trek in a kangaroo’s pouch (which was rather unpleasant and sticky as it turns out), I am in Australia. My trip to Australia is part business and part anthropologic study. On the latter’s account, I’ve been taking detailed notes on my observations from Australia and I thought I’d share them with you:

The Flight

This damn neck pillow is extremely uncomfortable. Perhaps this is the worst $12 I’ve ever spent. I don’t understand how people can sleep with this thing on. I fear this is going to a very long flight.

Arriving in Sydney

Well, here I am! My neck feels as if it’s been jabbed by a thousand daggers, but my spirit feels as if it’s been hugged by a thousand loving teddy bears! What a marvellous country—McDonalds and Starbucks as far as the eye can see. It’s somewhat disturbing though to see miles of uninterrupted beaches and undeveloped waterfront property. What has this crazy world come to?!

Settling In

Hum dee dum. After a few days in Sydney, I feel like a regular ole Australian. I’ve taken a new nickname (“Thorpedo”), bought some surfing-related t-shirts, and am currently practicing for an upcoming long-bow tournament. Put another shrimp on the barby, eh!

Anyhow, most of these observations will later be published in the Annals of Dingo Affairs, but I thought you might want a sneak peek!

The Flight

This damn neck pillow is extremely uncomfortable. Perhaps this is the worst $12 I’ve ever spent. I don’t understand how people can sleep with this thing on. I fear this is going to a very long flight.

Arriving in Sydney

Well, here I am! My neck feels as if it’s been jabbed by a thousand daggers, but my spirit feels as if it’s been hugged by a thousand loving teddy bears! What a marvellous country—McDonalds and Starbucks as far as the eye can see. It’s somewhat disturbing though to see miles of uninterrupted beaches and undeveloped waterfront property. What has this crazy world come to?!

Settling In

Hum dee dum. After a few days in Sydney, I feel like a regular ole Australian. I’ve taken a new nickname (“Thorpedo”), bought some surfing-related t-shirts, and am currently practicing for an upcoming long-bow tournament. Put another shrimp on the barby, eh!

Anyhow, most of these observations will later be published in the Annals of Dingo Affairs, but I thought you might want a sneak peek!

Sunday, August 27, 2006

A Tricky Way to Get Web Traffic

Here's a zany idea for folks who want to attract some traffic to their websites.

As many of you know, there is a very popular news site called Digg.com where users flag (they "digg" them) interesting news stories. The ones that get flagged/digged the most end up going to the front page where millions of visitors read the stories. While it is aimed at sort of a "democratization" of the news, the end result is that some interesting odd-ball articles and websites bubble to the top.

If you wanted web traffic, in theory, you could try to get your friends to "digg" your website so it would be seen by millions of people. The problem with this, however, is Digg has a very efficient and large community of users who digg articles. You would literally need 1000's of people to digg your site to make a blip on the website.

However, a few weeks ago, Netscape.com converted its format to be a copycat of Digg. Netscape is a huge but declining portal (I guess from the days when people used netscape browsers) with millions of visitors per day. However, they have very few "diggers" who flag articles. In fact, all you need is a couple of dozen people to flag your site/blog to make it on the main page and get exposed to millions. It's a temporary anomaly that their readership is disproporationately large compared to the number of people who influence what makes the main page. My guess is you could pretty easily influence what shows up on netscape.com

So, if you're doing something interesting, why start a compaign to get it posted on Netscape.com?

As many of you know, there is a very popular news site called Digg.com where users flag (they "digg" them) interesting news stories. The ones that get flagged/digged the most end up going to the front page where millions of visitors read the stories. While it is aimed at sort of a "democratization" of the news, the end result is that some interesting odd-ball articles and websites bubble to the top.

If you wanted web traffic, in theory, you could try to get your friends to "digg" your website so it would be seen by millions of people. The problem with this, however, is Digg has a very efficient and large community of users who digg articles. You would literally need 1000's of people to digg your site to make a blip on the website.

However, a few weeks ago, Netscape.com converted its format to be a copycat of Digg. Netscape is a huge but declining portal (I guess from the days when people used netscape browsers) with millions of visitors per day. However, they have very few "diggers" who flag articles. In fact, all you need is a couple of dozen people to flag your site/blog to make it on the main page and get exposed to millions. It's a temporary anomaly that their readership is disproporationately large compared to the number of people who influence what makes the main page. My guess is you could pretty easily influence what shows up on netscape.com

So, if you're doing something interesting, why start a compaign to get it posted on Netscape.com?

Thursday, August 17, 2006

Remember That You Like Pants

Dear Readers,

Tomorrow I shall ride my kangaroo off into the glorious sunset. That is to say, I'll be going to Australia for the next 5-weeks on a secret mission to preserve the global economic order. If all goes to plan, by the time I return, the SP 500 will have risen from 1300 to 1400. If I fail, however, we may plunge into a prolonged global recession. In retrospect, the downside risk of this mission hardly seemly commensurate with the potential upside.

Let me leave you with some tidbits of wisdom to abide by in my physical absence from the continent. First, beware of ner-do-wells who compel you to admit that you "hate pants". Second, remain neutral in the event of a war between England and France. Finally, tend to the children, for they are our future.

My next blog will be posted from the other side of the world, which is a miracle of technology that still blows my mind.

Your humble servant,

Rohin

Tomorrow I shall ride my kangaroo off into the glorious sunset. That is to say, I'll be going to Australia for the next 5-weeks on a secret mission to preserve the global economic order. If all goes to plan, by the time I return, the SP 500 will have risen from 1300 to 1400. If I fail, however, we may plunge into a prolonged global recession. In retrospect, the downside risk of this mission hardly seemly commensurate with the potential upside.

Let me leave you with some tidbits of wisdom to abide by in my physical absence from the continent. First, beware of ner-do-wells who compel you to admit that you "hate pants". Second, remain neutral in the event of a war between England and France. Finally, tend to the children, for they are our future.

My next blog will be posted from the other side of the world, which is a miracle of technology that still blows my mind.

Your humble servant,

Rohin

Friday, August 04, 2006

Waking Up is Hard to Do

The fascinating thing about the capitalist system is it compels billions of people to wake up each day and go to a job that most likely they find unpleasant. Achieving this level of coordination is a feat no short of remarkable. I feel so sleepy and crummy every morning when I wake up, yet some how I’ll pitch up for work, even if I know I’ll spend the day valuing plain-vanilla coconut derivatives. Tom Wolfe, in Bonfire of the Vanities, captures perfectly how I feel when my alarm sounds in the morning:

The telephone blasted Peter Fallow awake inside an egg with the shell peeled away and only the membranous sac holding it intact. Ah! The membranous sac was his head, and the right side of his head was on the pillow, and the yolk was as heavy as mercury, and it rolled like mercury, and it was pressing down on his right temple and his right eye and his right ear. If he tried to get up to answer the telephone, the yolk, the mercury, the poisoned mass, would shift and roll and rupture the sac, and his brains would fall out.

There are a variety of reasons that motivate people to wake up and go to work, but the end result is stunning—people make things and people stay out of a trouble. On the first point, the entirety of human progress over the last 300 years [or at least improvements in standards of living] can be attributed to productivity gains that have compounded over time. People show up in the morning, maybe a bit disheveled and sleepy, but eventually, after a few cups of coffee, they do something. They improve some code, find a new way to make a product, or if they’re extremely ambitious, write a blog. Over time, these modest improvements compound upon each other in a staggering way. If 300 years ago, you started with $100 in capital and every year just improved it somehow by about 5%, you’d have $225 MM today. If interspersed every 50 years was some sort of productivity revolution (like computers, factories, transportation), before then settling into steady 5% growth, you’d have $1.9 BN today. So if over the course of they year, you just make thing 5% better than last, you’re doing sweet!

The other notable feat of capitalism is that it keeps people occupied. If you’re working 95 hours a week as an investment banker, frankly, you don’t have time to throw Molotov cocktails at your foes. Imagine how pissed your boss would be if you didn’t have the document ready for a client meeting because you had gotten in a fracas with some ethnic rivals. He’d have a frickin’ aneurism!

Boss: Rohin, we’re meeting with Procter & Gamble in 30 minutes to discuss the Gillette acquisition. Is the document ready?

Rohin: Well, no, not so much really. I was hoping maybe you could just “talk to” the main points instead of presenting the slides.

Boss: [face reddening] What do you mean?

Rohin: Well there are no slides really. I was working on the pitch last night and I went out to pick up some sushi for dinner that I planned to eat back at my desk. As I was walking back to the office, I saw [insert rival ethnic group here] folks milling about in front of a Starbucks. I was filled with an uncontrollable rage and started throwing sushi at them. Piece by piece, I flung sushi at them for hours. I even hit one of them in the eye with wasabi! This fellow may have had the last laugh though as he poured a non-fat latte on my Thomas Pink shirt—the dry cleaning bill will not be pretty.

As much as the boss may have sympathized with my cause, I just cost him $7 MM in income this year if we had won the business. That's a house in Westchester with a pool!

So my solution to solving all ethnic and political conflicts – give them jobs as investment bankers or possibly as management consultants or coconut arbitrageurs.

The telephone blasted Peter Fallow awake inside an egg with the shell peeled away and only the membranous sac holding it intact. Ah! The membranous sac was his head, and the right side of his head was on the pillow, and the yolk was as heavy as mercury, and it rolled like mercury, and it was pressing down on his right temple and his right eye and his right ear. If he tried to get up to answer the telephone, the yolk, the mercury, the poisoned mass, would shift and roll and rupture the sac, and his brains would fall out.

There are a variety of reasons that motivate people to wake up and go to work, but the end result is stunning—people make things and people stay out of a trouble. On the first point, the entirety of human progress over the last 300 years [or at least improvements in standards of living] can be attributed to productivity gains that have compounded over time. People show up in the morning, maybe a bit disheveled and sleepy, but eventually, after a few cups of coffee, they do something. They improve some code, find a new way to make a product, or if they’re extremely ambitious, write a blog. Over time, these modest improvements compound upon each other in a staggering way. If 300 years ago, you started with $100 in capital and every year just improved it somehow by about 5%, you’d have $225 MM today. If interspersed every 50 years was some sort of productivity revolution (like computers, factories, transportation), before then settling into steady 5% growth, you’d have $1.9 BN today. So if over the course of they year, you just make thing 5% better than last, you’re doing sweet!

The other notable feat of capitalism is that it keeps people occupied. If you’re working 95 hours a week as an investment banker, frankly, you don’t have time to throw Molotov cocktails at your foes. Imagine how pissed your boss would be if you didn’t have the document ready for a client meeting because you had gotten in a fracas with some ethnic rivals. He’d have a frickin’ aneurism!

Boss: Rohin, we’re meeting with Procter & Gamble in 30 minutes to discuss the Gillette acquisition. Is the document ready?

Rohin: Well, no, not so much really. I was hoping maybe you could just “talk to” the main points instead of presenting the slides.

Boss: [face reddening] What do you mean?

Rohin: Well there are no slides really. I was working on the pitch last night and I went out to pick up some sushi for dinner that I planned to eat back at my desk. As I was walking back to the office, I saw [insert rival ethnic group here] folks milling about in front of a Starbucks. I was filled with an uncontrollable rage and started throwing sushi at them. Piece by piece, I flung sushi at them for hours. I even hit one of them in the eye with wasabi! This fellow may have had the last laugh though as he poured a non-fat latte on my Thomas Pink shirt—the dry cleaning bill will not be pretty.

As much as the boss may have sympathized with my cause, I just cost him $7 MM in income this year if we had won the business. That's a house in Westchester with a pool!

So my solution to solving all ethnic and political conflicts – give them jobs as investment bankers or possibly as management consultants or coconut arbitrageurs.

Friday, July 28, 2006

Pitchfork Media

For those who are interested in independent and alternative rock, reading Pitchfork Media is a must. Without a doubt, it is the most comprehensive, insightful, and influential source of music criticism in this genre. There is an excellent article about Pitchfork by the Kiera Butler in the Columbia Journalism review that I would recommend to anyone with a passing interest in the “business of music”.

I’ve always been struck that Pitchfork is an under-utilized asset. The amount of spending on albums and concerts that it directly influences must be staggering. I spend relatively little on music and concerts (and practically nothing since I’ve gone back to school), but I’d venture that they’ve directly influenced about $100 of my spending per year. They have 160,000 visitors every day. Assuming their visitors come by once a week only, this translates into an audience of 1.1 MM unique readers (this estimate is probably a bit high, but should be in the right ballpark). If my spending is representative of the mean, that means that Pitchfork influences approximately $100 MM in spending a year; this is a huge percentage of the amount of money spent on indie rock albums and concerts.

Yet for all this influence over spending, Pitchfork can’t be making a more than a couple of million bucks a year. They have some rinky dinky adds for t-shirts and links to a music buying website (which I imagine pays them a commission), but the "company" definitely has a garage-quality feel to it.

Pitchfork has a fundamental business problem though. It is successful because it is objective, but it is also poor because it is objective. I’m sure the musical labels, retailers, and concert promoters would pay handsomely to get Pitchfork to steer some business their way. Doing so, however, would completely undermine Pitchfork as a an objective source of music criticism.

Providing information, analysis, and recommendations is an inherently difficult way to make money. Each of the ways I can think of to monetize this information has huge drawbacks:

Option 1: Sell out. As discussed earlier, this has huge drawbacks. However, shopping comparison sites like Cnet.com and shopping.com have very successfully given preferential treatment to vendors in exchange for fees. Google Adwords, has found a pretty neat way to do this as well by placing the sponsored ads on the side. However, empirical research has shown people are much more likely to click through to an advertisement when they have search intent not when they see some add next to the content they are leisurely perusing.

Option 2: Charge for access to information. This is tricky since charging subscription fees narrows your customer reach and therefore your influence. However, Zagats, CarFax, etc have managed to pull this off. It’s way to salvage some of the value you are creating but difficult to really grow this way.

Option 3: Focus on big ticket items. Many information-based car-buying sites do quite well because advertisers are willing to spend a bit to potentially bring in a large chunk of revenue. I really have no clue how this could apply to Pitchfork; I’m just throwing it out there.

Option 4: Get your paws on the rest of the value chain. The value pitchfork creates being spread out record labels, distributors (like Amazon), concert promoters, ticket exchanges (like StubHub). There are so many players getting money off of Pitchfork, it makes nearly intractable for Pitchfork to monetize this value by making financial agreements with these companies. They have an agreement with one distributor site, but that probably only captures a small fraction of the value creation. Pitchfork needs to cast a wide net and make agreements with all of the major parties that are profiting off them. If someone goes to Pitchfork and views a review of new band, Pitchfork needs to be paid if a week later that person buys the album on Amazon or purchases a ticket through Tickets.com or StubbHub. There are easy to implement technical solutions to achieve this, but Pitchfork needs to go out and demand to get money from all these parties. My guess is Pitchfork needs to hire one bulldog, and make he/she antagonizes the heck out of the music industry until they comply. All you need is a few players to agree and the rest will fall in line.

Just this last weekend, Pitchfork put on a massively successful concert in Chicago. This is certainly a step in the right direction, but still the company is only being compensated for a fraction of the ticket sales that they influence in the industry.

I’ve always been struck that Pitchfork is an under-utilized asset. The amount of spending on albums and concerts that it directly influences must be staggering. I spend relatively little on music and concerts (and practically nothing since I’ve gone back to school), but I’d venture that they’ve directly influenced about $100 of my spending per year. They have 160,000 visitors every day. Assuming their visitors come by once a week only, this translates into an audience of 1.1 MM unique readers (this estimate is probably a bit high, but should be in the right ballpark). If my spending is representative of the mean, that means that Pitchfork influences approximately $100 MM in spending a year; this is a huge percentage of the amount of money spent on indie rock albums and concerts.

Yet for all this influence over spending, Pitchfork can’t be making a more than a couple of million bucks a year. They have some rinky dinky adds for t-shirts and links to a music buying website (which I imagine pays them a commission), but the "company" definitely has a garage-quality feel to it.

Pitchfork has a fundamental business problem though. It is successful because it is objective, but it is also poor because it is objective. I’m sure the musical labels, retailers, and concert promoters would pay handsomely to get Pitchfork to steer some business their way. Doing so, however, would completely undermine Pitchfork as a an objective source of music criticism.

Providing information, analysis, and recommendations is an inherently difficult way to make money. Each of the ways I can think of to monetize this information has huge drawbacks:

Option 1: Sell out. As discussed earlier, this has huge drawbacks. However, shopping comparison sites like Cnet.com and shopping.com have very successfully given preferential treatment to vendors in exchange for fees. Google Adwords, has found a pretty neat way to do this as well by placing the sponsored ads on the side. However, empirical research has shown people are much more likely to click through to an advertisement when they have search intent not when they see some add next to the content they are leisurely perusing.

Option 2: Charge for access to information. This is tricky since charging subscription fees narrows your customer reach and therefore your influence. However, Zagats, CarFax, etc have managed to pull this off. It’s way to salvage some of the value you are creating but difficult to really grow this way.

Option 3: Focus on big ticket items. Many information-based car-buying sites do quite well because advertisers are willing to spend a bit to potentially bring in a large chunk of revenue. I really have no clue how this could apply to Pitchfork; I’m just throwing it out there.

Option 4: Get your paws on the rest of the value chain. The value pitchfork creates being spread out record labels, distributors (like Amazon), concert promoters, ticket exchanges (like StubHub). There are so many players getting money off of Pitchfork, it makes nearly intractable for Pitchfork to monetize this value by making financial agreements with these companies. They have an agreement with one distributor site, but that probably only captures a small fraction of the value creation. Pitchfork needs to cast a wide net and make agreements with all of the major parties that are profiting off them. If someone goes to Pitchfork and views a review of new band, Pitchfork needs to be paid if a week later that person buys the album on Amazon or purchases a ticket through Tickets.com or StubbHub. There are easy to implement technical solutions to achieve this, but Pitchfork needs to go out and demand to get money from all these parties. My guess is Pitchfork needs to hire one bulldog, and make he/she antagonizes the heck out of the music industry until they comply. All you need is a few players to agree and the rest will fall in line.

Just this last weekend, Pitchfork put on a massively successful concert in Chicago. This is certainly a step in the right direction, but still the company is only being compensated for a fraction of the ticket sales that they influence in the industry.

Wednesday, July 26, 2006

An Open Letter to Spammers

Dear Spammers,

Greetings! Wait, don’t delete this email, it’s not what you think. In fact, I’m not mad at you guys. Sure you fill my inbox with hundreds of ridiculous emails every day, but I’m cool with that. I realize that reaching customers and distributing your product is a difficult and expensive proposition. An outbound phone call (telemarketing) can cost $10-20 per call. Heck, visiting your customers can cost you about $100. Sending an email, on the other hand, is practically free. Spamming just makes good economic sense.

The reason I’m writing though is to offer you advice. Don’t get me wrong, I think you are doing a fantastic job! I just think there are some simple steps you can take to improve your productivity and profitability dramatically.

Let the data be your guide

Click-through-rates for spam are higher than most people would expect. Click-through-rates for the three most successful categories are 5.6% for pornography, 0.02% for pharmacy, and 0.0075% for Rolex watches.

Wow, that’s a pretty amazing rate for naughty pictures. If you assume that emails are evenly sent to both men and women and assume men are the ones that click through (this may be a big assumption, I don’t know), that means dudes click through at a 11.2% rate. What fantastic customer reach! Hats off to you, Spammy McGee!

However, maybe it’s time to stop wasting your energy on all other categories and just stick to this industry? Play to your strengths Spammer Dude!

Be funny!

I actually open spam sometimes just because the message cracks me up. This is a message that I got a few months ago and I sent it around to some of my friends because I liked it so much.

---Forwarded Message---

Date: Fri, 10 Feb 2006 15:41:30 +0180

From: "Alvin Coley"

Reply-To: "Alvin Coley"

Subject: Former President Bill Klinton uses Voagra!

Everybody knows the great sexual scandal known as

"Klinton-Levinsky". After the relations like this Klintons

popularity raised a lot! It is a natural phenomenon, because

Bill as a real man in order not to shame himself when he was

with Monica regularly used Voagra. What happened you see. His

political figure became more bright and more attractive. It is

very important for a man to be respected as a man!

See our Voagra shop to enter upon the new phase of your life.

http://ferrurne.com/

--------------------------

While being funny is a great strategy, spammers can do more things to improve the likelihood that I open the message. Having my name in the title, giving me some direct command, or tricking me into thinking it’s a real email makes me marginally more likely to open the email. On the other hand, having bizarre names as the sender (Scanning my inbox: Selflessness C. Acoustics, Deflector D. Inscriptions come to mind), and giveaway titles (pharmacy, Rolex) make me less likely to open it.

Leverage your core asset to create alternative profit streams

This may seem like a fatuous MBA statement, but stick with me here, this is clever. The distinguishing characteristic of a spam is that it annoys the heck out of people and makes people despise the companies that advertise through the channel. Rolex, in fact, is very troubled that its name pops up in everyone’s inbox every day; in the long run, this will deteriorate the brand’s equity.

There are a lot of organizations that are willing to pay money to have someone else’s brand tarnished. [Note to reader: I am not advocating this position. In fact, I don’t think any business would pay to tarnish its competitors reputation through a spamming] Militant non-profit advocacy groups just might be interested!

One example we studied in class was the Rainforest Action Network (RAN). Their strategy was to target companies with strong consumer brands who were somehow related to rain forest deforestation. Basically RAN would tear the company’s brands to shreds until unfavorable practices were stopped. For example, since Citigroup provided financing to many of the forestry companies, RAN launched a campaign involving boycotts, sit-ins, vandalism, protests, all aimed at smearing the Citigroup’s consumer brand. Eventually, Citigroup complied as the smear campaign made it increasingly difficult for the company to sell credit cards and loans to consumers.

Can you imagine if RAN had hired a spammer though? What would you think of Citigroup if everyday you got emails entitled:

“Go to Citgroup.com for ViaGRAH”

“Great Drugs and Credit Cards from Citi”

“Your homeloan has been processed by CitiGroup”

“Important message from CitiGroup regarding your mortgage”

“Please Verify Citigroup Account Information”

Holy crap! Citigroup would be in big trouble [again I am not advocating someone do this! Frankly, I’m a bit surprised that some non-profits actually use analogous tactics]

Anyhow spammers, I hope you find some of this advice useful. If you want to discuss this further, give me a shout! Keep on rocking!

Rohin

Greetings! Wait, don’t delete this email, it’s not what you think. In fact, I’m not mad at you guys. Sure you fill my inbox with hundreds of ridiculous emails every day, but I’m cool with that. I realize that reaching customers and distributing your product is a difficult and expensive proposition. An outbound phone call (telemarketing) can cost $10-20 per call. Heck, visiting your customers can cost you about $100. Sending an email, on the other hand, is practically free. Spamming just makes good economic sense.

The reason I’m writing though is to offer you advice. Don’t get me wrong, I think you are doing a fantastic job! I just think there are some simple steps you can take to improve your productivity and profitability dramatically.

Let the data be your guide

Click-through-rates for spam are higher than most people would expect. Click-through-rates for the three most successful categories are 5.6% for pornography, 0.02% for pharmacy, and 0.0075% for Rolex watches.

Wow, that’s a pretty amazing rate for naughty pictures. If you assume that emails are evenly sent to both men and women and assume men are the ones that click through (this may be a big assumption, I don’t know), that means dudes click through at a 11.2% rate. What fantastic customer reach! Hats off to you, Spammy McGee!

However, maybe it’s time to stop wasting your energy on all other categories and just stick to this industry? Play to your strengths Spammer Dude!

Be funny!

I actually open spam sometimes just because the message cracks me up. This is a message that I got a few months ago and I sent it around to some of my friends because I liked it so much.

---Forwarded Message---

Date: Fri, 10 Feb 2006 15:41:30 +0180

From: "Alvin Coley"

Reply-To: "Alvin Coley"

Subject: Former President Bill Klinton uses Voagra!

Everybody knows the great sexual scandal known as

"Klinton-Levinsky". After the relations like this Klintons

popularity raised a lot! It is a natural phenomenon, because

Bill as a real man in order not to shame himself when he was

with Monica regularly used Voagra. What happened you see. His

political figure became more bright and more attractive. It is

very important for a man to be respected as a man!

See our Voagra shop to enter upon the new phase of your life.

http://ferrurne.com/

--------------------------

While being funny is a great strategy, spammers can do more things to improve the likelihood that I open the message. Having my name in the title, giving me some direct command, or tricking me into thinking it’s a real email makes me marginally more likely to open the email. On the other hand, having bizarre names as the sender (Scanning my inbox: Selflessness C. Acoustics, Deflector D. Inscriptions come to mind), and giveaway titles (pharmacy, Rolex) make me less likely to open it.

Leverage your core asset to create alternative profit streams

This may seem like a fatuous MBA statement, but stick with me here, this is clever. The distinguishing characteristic of a spam is that it annoys the heck out of people and makes people despise the companies that advertise through the channel. Rolex, in fact, is very troubled that its name pops up in everyone’s inbox every day; in the long run, this will deteriorate the brand’s equity.

There are a lot of organizations that are willing to pay money to have someone else’s brand tarnished. [Note to reader: I am not advocating this position. In fact, I don’t think any business would pay to tarnish its competitors reputation through a spamming] Militant non-profit advocacy groups just might be interested!

One example we studied in class was the Rainforest Action Network (RAN). Their strategy was to target companies with strong consumer brands who were somehow related to rain forest deforestation. Basically RAN would tear the company’s brands to shreds until unfavorable practices were stopped. For example, since Citigroup provided financing to many of the forestry companies, RAN launched a campaign involving boycotts, sit-ins, vandalism, protests, all aimed at smearing the Citigroup’s consumer brand. Eventually, Citigroup complied as the smear campaign made it increasingly difficult for the company to sell credit cards and loans to consumers.

Can you imagine if RAN had hired a spammer though? What would you think of Citigroup if everyday you got emails entitled:

“Go to Citgroup.com for ViaGRAH”

“Great Drugs and Credit Cards from Citi”

“Your homeloan has been processed by CitiGroup”

“Important message from CitiGroup regarding your mortgage”

“Please Verify Citigroup Account Information”

Holy crap! Citigroup would be in big trouble [again I am not advocating someone do this! Frankly, I’m a bit surprised that some non-profits actually use analogous tactics]

Anyhow spammers, I hope you find some of this advice useful. If you want to discuss this further, give me a shout! Keep on rocking!

Rohin

Thursday, July 20, 2006

What's the deal with...Meetings?!

I’ve been in a lot of meetings in the half decade or so that I’ve been in the working world. There are of course, bad meetings and good meetings. Bad meetings are dastardly affairs, often involving folks wearing turtlenecks talking for the sake of hearing themselves talk. These sorts of meetings are particularly pernicious since nothing gets done. My friends can attest that I’m not morally opposed to “nothing getting done”, but in the past that has resulted in me staying up very very late making sure stuff does eventually get done.

A good meeting, however, can be an excellent experience. You and your team are trying to make an important point, and the entire meeting is a structured exercise to convince your client/customer/partner that your point is correct. You could be convincing them to enter a new market, buy your product, or give you financing. Generally, your “opponent” in the meeting will resist your rhetorical advances and the meeting becomes a drawn out struggle, not unlike a football game. You advance ten yards, then they push you back a few, you keeping pushing on until you score.

In this kind of meeting, you are either a “lineman” or a “quarterback”. A lineman is responsible for all the blocking and tacking that allows you to advance a few yards at a time. The preparation of the materials, the presentation of the facts, and the defense of its validity all falls to the lineman. Being a lineman is a grueling job and one I know quite well.

Al Pacino described what it’s like to be this guy before a big meeting quite well in the movie “Any Given Sunday” [I don't know why Al was talking about meeting etiquette in a movie about football]:

I don't know what to say really. Three minutes till the biggest battle of our professional lives. It all comes down to today. Now either we heal as a team, or we're gonna crumble. Inch by inch, play by play, till we're finished. We're in hell right now, gentlemen. Believe me. And we can stay here, get the sh*t kicked out of us, or we can fight our way back into the light. We can climb out of hell. One inch at a time.

….

On this team, we fight for that inch. On this team, we tear ourselves and everyone else around us to pieces for that inch. We claw with our fingernails for that inch. Because we know when we add up all those inches, that's gonna make the f*cking difference between winning and losing! Between living and dying! I'll tell you this - in any fight, its the guy whose willing to die who's gonna win that inch.

Frankly, I get tired just thinking about fighting over all these inches! It’s taxing work. In theory, part of the reason for going to business school is to learn how transform your self from the “lineman” to the “quarterback”. The quarterback is the one who has the power to move the ball, 20, 50 yards at a time. He or she might be the CEO, the Managing Director, the Head of Sales. Sure he/she needs all the blocking and tackling in place, but his job is to throw the Hail Mary when the opportunity presents itself. Throwing this knockout punch (sorry to mix metaphors, well not so sorry) is largely a rhetorical technique that the quarterback has perfected. The quarterback comes in many forms, here are a few:

The pensive oracle

This quarterback thinks he’s so sneaky, but I see through his little act. In a three hour meeting, he’ll spend about two hours staring out the window as if to say, “Hey don’t mind me over here fellows, I’m above the fray”. As the debate reaches its crescendo, he’ll turn to the audience and say, “It seems to me [insert obvious thing that everyone in the room can agree on], perhaps we should [insert simple activity that everyone can agree on]”. Amazingly, this seems to quell everyone in the room and set the course for the last hour. During the last hour of the meeting, our friend the Oracle can take a nap with his eyes open.

The visceral character-attacker

I’ve seen this fellow at work during meetings about personnel when you’re deciding whether to hire a candidate. People will be buzzing about, making arguments about the candidates pro’s and con’s. This guy will inevitably be against the candidate and say something like “I wouldn’t hire this guy to mow my lawn.” [This was actually a real quote!] Everyone in the room is instantly silenced. What do you say to something like that... “Well actually, he was a member of the Outdoors Club so he probably could mow your lawn quite well.” It’s very difficult to rebut these character attacks [I think politicians have noticed this fact].

The assured know-it-all

This guy is at the top of his game when there is a bit of confusion in the room. He’ll let Camp A and Camp B flounder over an issue back and forth until they’ve confused the heck out of each other. At this precise moment, he’ll pounce and say with all the smugness he can muster “Back in my ill-informed youth, I was of the opinion of [Camp A]. However, because of [X,Y,Z] I’ve disabused myself of that notion. [Camp B] is well intentioned, but ultimately misguided because of [X,Y,Z]. In fact, the only possible answer is [C] because of [X,Y,Z]”. The most infuriating thing about this guy is he’s usually right and therefore quite effective.

The hop-up excited and draw on the whiteboard guy

Eureka! This quarterback has had a moment of blinding insight that must be shared with the whole room. He runs to the white board and proudly draws a triangle. That’s it, the answer is a triangle! As the audience bathes in the glow of insight, the quarterback further articulates his point with wild gesticulations, further whipping the audience into a frenzy! Oh my!

The homespun wisdom guy

Ah shucks! This gentleman tries to lull you into a false sense of security by pretending to be illiterate. But don't be fooled, this unfrozen caveman lawyer is smart as a whip. This guy has a lot of good quotes, but my favorite is when he uses the Henry Ford quote, “If I’d asked my customers what they wanted, they’d have said a faster horse”. This is such a good quote on so many levels. I love you homespun wisdom guy! Down with market research!

Anyhow, these are my business meeting role models. Go figure.

A good meeting, however, can be an excellent experience. You and your team are trying to make an important point, and the entire meeting is a structured exercise to convince your client/customer/partner that your point is correct. You could be convincing them to enter a new market, buy your product, or give you financing. Generally, your “opponent” in the meeting will resist your rhetorical advances and the meeting becomes a drawn out struggle, not unlike a football game. You advance ten yards, then they push you back a few, you keeping pushing on until you score.

In this kind of meeting, you are either a “lineman” or a “quarterback”. A lineman is responsible for all the blocking and tacking that allows you to advance a few yards at a time. The preparation of the materials, the presentation of the facts, and the defense of its validity all falls to the lineman. Being a lineman is a grueling job and one I know quite well.

Al Pacino described what it’s like to be this guy before a big meeting quite well in the movie “Any Given Sunday” [I don't know why Al was talking about meeting etiquette in a movie about football]:

I don't know what to say really. Three minutes till the biggest battle of our professional lives. It all comes down to today. Now either we heal as a team, or we're gonna crumble. Inch by inch, play by play, till we're finished. We're in hell right now, gentlemen. Believe me. And we can stay here, get the sh*t kicked out of us, or we can fight our way back into the light. We can climb out of hell. One inch at a time.

….

On this team, we fight for that inch. On this team, we tear ourselves and everyone else around us to pieces for that inch. We claw with our fingernails for that inch. Because we know when we add up all those inches, that's gonna make the f*cking difference between winning and losing! Between living and dying! I'll tell you this - in any fight, its the guy whose willing to die who's gonna win that inch.

Frankly, I get tired just thinking about fighting over all these inches! It’s taxing work. In theory, part of the reason for going to business school is to learn how transform your self from the “lineman” to the “quarterback”. The quarterback is the one who has the power to move the ball, 20, 50 yards at a time. He or she might be the CEO, the Managing Director, the Head of Sales. Sure he/she needs all the blocking and tackling in place, but his job is to throw the Hail Mary when the opportunity presents itself. Throwing this knockout punch (sorry to mix metaphors, well not so sorry) is largely a rhetorical technique that the quarterback has perfected. The quarterback comes in many forms, here are a few:

The pensive oracle

This quarterback thinks he’s so sneaky, but I see through his little act. In a three hour meeting, he’ll spend about two hours staring out the window as if to say, “Hey don’t mind me over here fellows, I’m above the fray”. As the debate reaches its crescendo, he’ll turn to the audience and say, “It seems to me [insert obvious thing that everyone in the room can agree on], perhaps we should [insert simple activity that everyone can agree on]”. Amazingly, this seems to quell everyone in the room and set the course for the last hour. During the last hour of the meeting, our friend the Oracle can take a nap with his eyes open.

The visceral character-attacker

I’ve seen this fellow at work during meetings about personnel when you’re deciding whether to hire a candidate. People will be buzzing about, making arguments about the candidates pro’s and con’s. This guy will inevitably be against the candidate and say something like “I wouldn’t hire this guy to mow my lawn.” [This was actually a real quote!] Everyone in the room is instantly silenced. What do you say to something like that... “Well actually, he was a member of the Outdoors Club so he probably could mow your lawn quite well.” It’s very difficult to rebut these character attacks [I think politicians have noticed this fact].

The assured know-it-all

This guy is at the top of his game when there is a bit of confusion in the room. He’ll let Camp A and Camp B flounder over an issue back and forth until they’ve confused the heck out of each other. At this precise moment, he’ll pounce and say with all the smugness he can muster “Back in my ill-informed youth, I was of the opinion of [Camp A]. However, because of [X,Y,Z] I’ve disabused myself of that notion. [Camp B] is well intentioned, but ultimately misguided because of [X,Y,Z]. In fact, the only possible answer is [C] because of [X,Y,Z]”. The most infuriating thing about this guy is he’s usually right and therefore quite effective.

The hop-up excited and draw on the whiteboard guy

Eureka! This quarterback has had a moment of blinding insight that must be shared with the whole room. He runs to the white board and proudly draws a triangle. That’s it, the answer is a triangle! As the audience bathes in the glow of insight, the quarterback further articulates his point with wild gesticulations, further whipping the audience into a frenzy! Oh my!

The homespun wisdom guy

Ah shucks! This gentleman tries to lull you into a false sense of security by pretending to be illiterate. But don't be fooled, this unfrozen caveman lawyer is smart as a whip. This guy has a lot of good quotes, but my favorite is when he uses the Henry Ford quote, “If I’d asked my customers what they wanted, they’d have said a faster horse”. This is such a good quote on so many levels. I love you homespun wisdom guy! Down with market research!

Anyhow, these are my business meeting role models. Go figure.

Tuesday, July 18, 2006

YouTube: My Networking Misadventures

One of the primary skills to learn in business school is “networking”. When I first arrived at Stanford, I was very skeptical of the value and ethical validity of the practice. I pictured greasy men with double chins wearing turtlenecks and sport coats slapping each other heartily on their backs. Sure, this is an odd thing to associate with networking, but I had my reasons. Isn’t networking a substitute for getting by on your own merits? Isn’t networking treating someone merely as a means to an ends? Kant would certainly be displeased by this, if not by the turtlenecks.

I’ve since changed my tune. This isn’t surprising since business school in theory helps you hop from the “bad side” of the fence (no connections and network and having to get by on your own stinking merit), to the “good side” (pass me another martini, chums!).

But a blissful sense of entitlement and short memory isn’t the only reason I’ve changed my tune. What I’ve realized is that people control businesses and opportunities. Networking is in fact the only means to access many of these opportunities.

If you want to become a Venture Capitalist, it would be great if you could just google the term and submit your resume somewhere. Unfortunately, information about opportunities isn't transmitted that way, it's transmitted via people and their interconnected network of relations. You need to get out there and talk to Venture Capitalists, understand their job and industry, and get your name out there. When a job opportunity comes up, maybe they'll think of you because they met you, not because they stumbled upon your resume on Monster. Learning how to network to find a job is the equiavalent of learning how to use Yahoo Finance to look up a stock or Google to find out the origin of the pinata. All these activities are exercises in gathering information as efficiently as possible.

Thus, when it came time to find a summer job, I threw on my turtleneck and started networking. I meet with alums, old clients, friends, friends of friends, fiends, and friends of fiends. I had quite a few misteps (putting the wrong date in my calendar for meetings, forgeting to look at my calendar on days I had scheduled meetings...) but also some fantastic meetings and conversations. While I had a few industries and jobs that I was very interested in learning more about, digital media was not on the list. However, for a variety of reasons (that I'll go into in another post) I became highly intersted in the online video space around the beginning of December.

In the beginning of December, online video didn't really exist. Google had just launched their service, but it was a mismash of garbage that was impossible to navigate. Sharlke, Blip.tv, Vidilife, Vimeo, Putfile, and ClipShack were easy to use, but lacked a critical mass of videos and viewers. One site, YouTube, however, stood out as being both easy to use and having enough videos and viewers that you could find some interesting content.

I dawdled around during Christmas break for a while, and when I returned, I decided to "reach out" to them (AKA network!). There are two things you need in order to network 1) Someone to talk to 2) Something to say. On the first point, sometimes it is easy to find someone to talk to. Generally, there are a lot of people out there who will bend over backwards to help you learn about an industry or company. They are especially helpful if you are a student and by definition not a competitor. However, in the case of YouTube, try as I might, all I had was an email address (jobs@youtube.com).

Sometimes you can get by without a good lead on someone to talk to if you have the second critera, "something to say" (and vice versa). When I say, "something to say" you need to have an bold opinion on some trend of factor that matters to the company. You might go up to the CEO of Dole Fruit and say, "I think Coconuts are terribly undervalued for the following reasons. 1) Almond Joy demand is forecaste to triple in the 4th quarter 2) Hollowed out Coconut shells are increasingly used as spare parts in aircraft repair 3) A lot of the leading hedge fund managers are rumored to be increasing their Coconut exposure."

Having an opinion on the industry at least demonstrates you're interested in the company and you've done some modicum of homework. So, I put on my thinking cap and tried to come up with some interesting things to say to this fledgling company. Below you can see my email and decided whether I had anything interesting to say. In retrospect it looks not.

From: Dhar, Rohin

Sent: Wed 1/25/2006 10:15 PM

To: 'jobs@youtube.com'

Subject: Stanford project with YouTube

Dear Chad, Steve & the YouTube team,

Just wanted to introduce myself. I'm a Stanford MBA student who is absolutely captivated by your product and user-experience. I very well believe that YouTube is positioned to 1) Drive the success of online video by allowing artists to disseminate and potentially monetize their work (like Google did for the written word) 2) Become a dominant media force, rivaling TV networks as a content distributor 3) Continue to build on its position as the leading video-based social network.

Defining where YouTube wants to go will be critical. Figuring out how YouTube gets there from here is even more critical.

This is a rapidly changing space where converting YouTube's strong position today into success over mammoth rivals like Google and Yahoo will depend on the "blocking and tackling" that YouTube pursues in its business strategy and operations over the next 3 months. Marketing, user experience, content development and organization, advertising decisions all play a role in determining YouTube's future success.

Since I'm currently a student (with a lot of prior business experience), I thought you could use a free resource to help you think about, plan, and pilot test the "game changing" moves that your company wants to make (and help with marketing). I'm very much interested in working with your company on this project. I know you've got lots of very talented people on your staff today producing the best product out there, but I feel I can be an important asset as someone who can help position YouTube to become the next Time Warner (and I who won't put a drag on your company's resources since I'm a student. Plus as a Stanford student, I can help YouTube tap into Stanford's vast array of useful resources for a startup).

I would really like to come by your office in the coming week to meet with someone to discuss this further. I am very impressed by your company so far and would love to help out. Please let me know if you are interested in discussing this further. This is going to be very very big!

Best regards and good luck!

Rohin

---------------------------

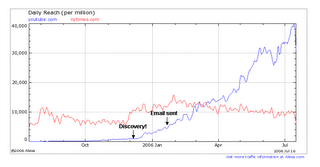

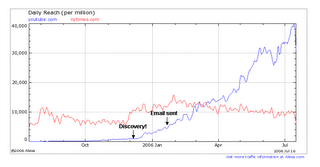

Anyhow, in this case, I received no respone from my "attempted networking". Generally it's tough to fire off an email to a generic address and get a respone (though I had quite good success doing this with other companies). Below is the a timeline from when I first heard of YouTube till today, plotted against their traffic data (versus nytimes.com for context). However, even before I "discovered/fist heard of" these guys, Sequoia Capital had already funded them. It just goes to show that in the venture business, you have to be really ahead of the curve to hit a homerun.

I've got some very strong opinions now on the space and how it will develop and what YouTube is doing right and wrong. I'll definitely write about that soon.

I've got some very strong opinions now on the space and how it will develop and what YouTube is doing right and wrong. I'll definitely write about that soon.

I’ve since changed my tune. This isn’t surprising since business school in theory helps you hop from the “bad side” of the fence (no connections and network and having to get by on your own stinking merit), to the “good side” (pass me another martini, chums!).

But a blissful sense of entitlement and short memory isn’t the only reason I’ve changed my tune. What I’ve realized is that people control businesses and opportunities. Networking is in fact the only means to access many of these opportunities.

If you want to become a Venture Capitalist, it would be great if you could just google the term and submit your resume somewhere. Unfortunately, information about opportunities isn't transmitted that way, it's transmitted via people and their interconnected network of relations. You need to get out there and talk to Venture Capitalists, understand their job and industry, and get your name out there. When a job opportunity comes up, maybe they'll think of you because they met you, not because they stumbled upon your resume on Monster. Learning how to network to find a job is the equiavalent of learning how to use Yahoo Finance to look up a stock or Google to find out the origin of the pinata. All these activities are exercises in gathering information as efficiently as possible.

Thus, when it came time to find a summer job, I threw on my turtleneck and started networking. I meet with alums, old clients, friends, friends of friends, fiends, and friends of fiends. I had quite a few misteps (putting the wrong date in my calendar for meetings, forgeting to look at my calendar on days I had scheduled meetings...) but also some fantastic meetings and conversations. While I had a few industries and jobs that I was very interested in learning more about, digital media was not on the list. However, for a variety of reasons (that I'll go into in another post) I became highly intersted in the online video space around the beginning of December.

In the beginning of December, online video didn't really exist. Google had just launched their service, but it was a mismash of garbage that was impossible to navigate. Sharlke, Blip.tv, Vidilife, Vimeo, Putfile, and ClipShack were easy to use, but lacked a critical mass of videos and viewers. One site, YouTube, however, stood out as being both easy to use and having enough videos and viewers that you could find some interesting content.

I dawdled around during Christmas break for a while, and when I returned, I decided to "reach out" to them (AKA network!). There are two things you need in order to network 1) Someone to talk to 2) Something to say. On the first point, sometimes it is easy to find someone to talk to. Generally, there are a lot of people out there who will bend over backwards to help you learn about an industry or company. They are especially helpful if you are a student and by definition not a competitor. However, in the case of YouTube, try as I might, all I had was an email address (jobs@youtube.com).

Sometimes you can get by without a good lead on someone to talk to if you have the second critera, "something to say" (and vice versa). When I say, "something to say" you need to have an bold opinion on some trend of factor that matters to the company. You might go up to the CEO of Dole Fruit and say, "I think Coconuts are terribly undervalued for the following reasons. 1) Almond Joy demand is forecaste to triple in the 4th quarter 2) Hollowed out Coconut shells are increasingly used as spare parts in aircraft repair 3) A lot of the leading hedge fund managers are rumored to be increasing their Coconut exposure."

Having an opinion on the industry at least demonstrates you're interested in the company and you've done some modicum of homework. So, I put on my thinking cap and tried to come up with some interesting things to say to this fledgling company. Below you can see my email and decided whether I had anything interesting to say. In retrospect it looks not.

From: Dhar, Rohin

Sent: Wed 1/25/2006 10:15 PM

To: 'jobs@youtube.com'

Subject: Stanford project with YouTube

Dear Chad, Steve & the YouTube team,

Just wanted to introduce myself. I'm a Stanford MBA student who is absolutely captivated by your product and user-experience. I very well believe that YouTube is positioned to 1) Drive the success of online video by allowing artists to disseminate and potentially monetize their work (like Google did for the written word) 2) Become a dominant media force, rivaling TV networks as a content distributor 3) Continue to build on its position as the leading video-based social network.

Defining where YouTube wants to go will be critical. Figuring out how YouTube gets there from here is even more critical.

This is a rapidly changing space where converting YouTube's strong position today into success over mammoth rivals like Google and Yahoo will depend on the "blocking and tackling" that YouTube pursues in its business strategy and operations over the next 3 months. Marketing, user experience, content development and organization, advertising decisions all play a role in determining YouTube's future success.

Since I'm currently a student (with a lot of prior business experience), I thought you could use a free resource to help you think about, plan, and pilot test the "game changing" moves that your company wants to make (and help with marketing). I'm very much interested in working with your company on this project. I know you've got lots of very talented people on your staff today producing the best product out there, but I feel I can be an important asset as someone who can help position YouTube to become the next Time Warner (and I who won't put a drag on your company's resources since I'm a student. Plus as a Stanford student, I can help YouTube tap into Stanford's vast array of useful resources for a startup).

I would really like to come by your office in the coming week to meet with someone to discuss this further. I am very impressed by your company so far and would love to help out. Please let me know if you are interested in discussing this further. This is going to be very very big!

Best regards and good luck!

Rohin

---------------------------

Anyhow, in this case, I received no respone from my "attempted networking". Generally it's tough to fire off an email to a generic address and get a respone (though I had quite good success doing this with other companies). Below is the a timeline from when I first heard of YouTube till today, plotted against their traffic data (versus nytimes.com for context). However, even before I "discovered/fist heard of" these guys, Sequoia Capital had already funded them. It just goes to show that in the venture business, you have to be really ahead of the curve to hit a homerun.

I've got some very strong opinions now on the space and how it will develop and what YouTube is doing right and wrong. I'll definitely write about that soon.

I've got some very strong opinions now on the space and how it will develop and what YouTube is doing right and wrong. I'll definitely write about that soon.

Chung is King of Marketing

Over the next couple of weeks, I'm going to write about some of the "ah-ha" moments I've had about important business principles and why they matter. By talking about how I came to that understanding, hopefully I will make the principle visceral to the reader and simulataneous fill up space on my blog. The first one I want to discuss is viral marketing, especially as it relates to the spreading of content.

Viral marketing is a simple principle. You tell one person, they tell all their friends, all their friends tell all their friends. It's like rabbits making babies. The initial growth trajectory of these networks appears exponential, though eventually it will peter out. Companies like Hotmail and Paypal all hardwired this marketing mechanism into their business models to great success.

What I find fascinating is the way great content spreads virally with virtually no effort or careful business planning. Great examples of this are the JibJab video and how the Lazy Sunday video tranformed Youtube.com into a major player in the entertainment industry.

My first experience with great, virally distributed content was the infamous Peter Chung / Carlyle Group email. It was the Spring of 2001 and I was an intern at JP Morgan investment banking. This gem of an email spread to every major investment bank, financial institution, and university in a matter of days. Peter had just left his job at Merryl Lynch investment banking to work at Carlyle in South Korea. This email is what he sent his former co-workers who proceeded to send it around Wall Street (apparently they didn't like him much). It's amazing the how powerful great content is. I wonder what Chung is up to these days? [Note, I edited the curse words slightly by adding the * character]

From: Peter Chung

Subject: LIVING LIKE A KING

Date: Tue, 15 May 2001 20:26:21 -0400

MIME-Version: 1.0

X-Mailer: Internet Mail Service (5.5.2653.19) Content-Type: text/plain

So I've been in Korea for about a week and a half now and what can I say, LIFE IS GOOD....

I've got a spanking brand new 2000 sq. foot 3 bedroom apt. with a 200 sq. foot terrace running the entire length of my apartment with a view overlooking Korea's main river and nightline. Why do I need 3 bedrooms? Good question, the main bedroom is for my queen size bed, where CHUNG is going to f*ck every hot chick in Korea over the next 2 years (5 down, 1,000,000,000 left to go) the second bedroom is for my harem of chickies, and the third bedroom is for all of you f*ckers when you come out to visit my ass in Korea.

I go out to Korea's finest clubs, bars and lounges pretty much every other night on the weekdays and everyday on the weekends to (I think in about 2 months, after I learn a little bit of the buyside business I'll probably go out every night on the weekdays). I know I was a stud in NYC but I pretty much get about, on average, 5-8 phone numbers a night and at least 3 hot chicks that say that they want to go home with me every night I go out.

I love the buyside, I have bankers calling me everyday with opportunties and they pretty much cater to my every whim - you know (golfing events, lavish dinners, a night out clubbing). The guys I work with are also all chilll - I live in the same apt building as my VP and he drives me around in his Porsche (1 of 3 in all of Korea) to work and when we go out. What can I say,.... live is good,...

CHUNG is KING of his domain here in Seoul

So, all of you f*ckers better keep in touch and start making plans to come out and visit my ass ASAP, I'll show you guys an unbelievable time.

My contact info is below.... Oh, by the way, someone's gotta start fedexing me boxes of domes, I

brought out about 40 but I think I'll run out of them by Saturday.....

Laters,

CHUNG

Peter Chung

The Carlyle Group

Suite 1009, CCMM Bldg.

12, Yoido-dong, Youngdeungpo-ku

Seoul 150-010, Korea

Tel: (822) 2004-8412

Fax: (822) 2004-8440

Viral marketing is a simple principle. You tell one person, they tell all their friends, all their friends tell all their friends. It's like rabbits making babies. The initial growth trajectory of these networks appears exponential, though eventually it will peter out. Companies like Hotmail and Paypal all hardwired this marketing mechanism into their business models to great success.

What I find fascinating is the way great content spreads virally with virtually no effort or careful business planning. Great examples of this are the JibJab video and how the Lazy Sunday video tranformed Youtube.com into a major player in the entertainment industry.